Executive Summary

Canada’s Chief Actuary has deceptively reported to millions of Canadians about the status of Canada Pension Plan. This means 17 million Canadians are being deprived of a deserved $170 billion, $10,000 each, on average. The CPP is not trivial. We have contributed, with our employer matching, as much as 10% of our lifetime earnings to the CPP, approaching $150,000.

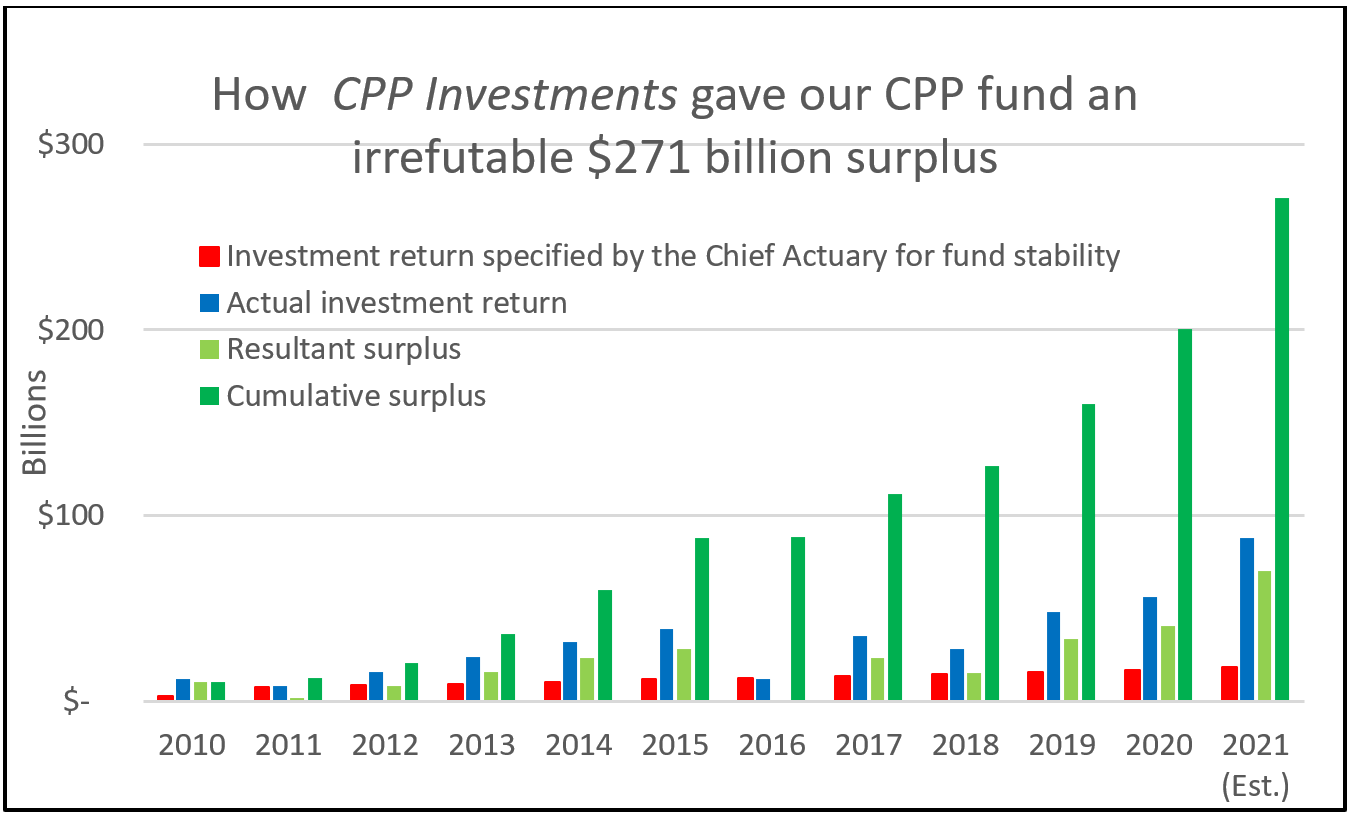

In 2010, our Chief Actuary stated he needed a CPP fund value of $293 billion on Dec. 31, 2021, to fund all pensions for the next 75 years. Then CPP Investments, probably the best pension fund investor in the world, averaged an outstanding 11% investment return per year.

This means our CPP fund will likely have a $564 billion value on Dec. 31, 2021, constituting a $271 billion, 92%, surplus.

Some experts claim the surplus is closer to 464% because of CPP Investments’ likely success in the future.

When a pension fund has a 25% surplus, it should be distributed. The CPP surplus is now between 92% and 464%. All other fund stability costs like our increased longevity and and many baby boomers retiring, have already been accounted for by our Chief Actuary.

In 2000, for example, when the Ryerson University pension plan had a mere 18% surplus, the CRA demanded a surplus distribution. My colleagues and I received as much as $20,000 each.

The CPP could safely distribute $170 billion of their $271 billion surplus resulting in huge benefits for Canadians and Canada. Such a surplus distribution would

give 17 million contributors and pensioners $10,000 each, on average,

double Canada’s GDP increase,

create 200,000 jobs,

reduce our deficit roughly by $50 billion,

increase charitable giving by possibly 1% of $170 billion, $1.7 billion,

reduce poverty.

Tragically, 50,000 low-income, struggling seniors are now dying every year without seeing a penny of their deserved $10,000. Two thirds are women.

Experts predict CPP Investments’ outstanding success will continue because they have many investment advantages over the average investor. This means CPP Investments could also help solve income inequality which has gotten much worse because of COVID-19.

Currently, your CPP contributions only receive a 4.4% investment return. Why not let CPP Investments, with their 10.8% return, directly invest for you, for example, the first $2,000 per year of your annual contributions.

This means all 25-year-old Canadians would likely have $1.4 million saved by age 65.

This $1.4 million could be cashed in or it would provide a $150,000 CPP pension.

For no extra cost, a 25-year-old would have 15 times the CPP pension, even after accounting for inflation.

There are also substantial benefits for older Canadians. For example, almost all 45-year-old Canadians would have $80,000 more available at age 65 with this policy.

Income inequality could be somewhat solved and elder poverty could be reduced. And spiraling social assistance for the elderly, scheduled to be $80 billion per year by 2025, could likely be halved.

No actuary, economist or politician has given any reasons to NOT share these huge benefits with Canadians and Canada.

However, three powerful industries would lose

The actuarial industry

Ten top actuaries have been consulted regarding the CPP’s surplus. They have all denied the surplus with vacuous arguments. This is likely because they know that, if CPP Investments continues so successfully, a 25-year-old could have a $100,000 CPP pension, in 2021 dollars. The need for other pension funds, and hence actuaries, would decline substantially.

We 20 million members of the CPP are not represented. All actuaries agree that every pension fund must have a Board of Governors, primarily comprised of contributors and pensioners like you and me. The CPP has no such Board of Governors. Moreover, our Chief Actuary is never audited. He only has a pathetic peer review, a “bromance of colleagues”. He has full control on reporting on billions of our dollars entrusted to him.

One top actuary, with a conscience, stated that our Chief Actuary,

“has done what pension actuaries frequently do - invent measures that are easily manipulated so that actuaries can control the narrative and hide things at will...I must remain anonymous because actuaries are not supposed to criticize other actuaries.”

For comparison, imagine the state of our country if MPs stated, “I am not supposed criticize other MPs”.

As a professor emeritus who has studied the CPP for over five years, I heartily concur with this disappointing assessment of our Chief Actuary.

The investment industry

The investment industry cannot compete with the high profits, low-risk, no-fraud and simplicity of CPP Investments. The industry is concerned that politicians could someday offer voluntary contributions to all Canadians, thereby transferring billions of investment dollars from their industry over to CPP Investments.

Toronto Financial International (TFI) represents all larger members of the financial industry, including all banks, pension funds, investment firms, insurance companies, accounting firms, large legal firms, government, and academia. Their assets total $10 trillion. TFI likely collects many millions of dollars in fees from their members to keep their lucrative industry prosperous. TFI is partners with Finance Minister Freeland, Premier Ford, and John Tory, but not you and me.

TFI is worried. When the trivial change to the CPP in 2016 was legislated, their spokesperson, Janet Ecker, stated in June 2016,

“The worry was it would undermine a lot of successful, legitimate (retirement savings) products in the investment industry.”

Who should be “undermined” – struggling Canadians or the lucrative investment industry? Their worry is greater than in 2016 because CPP Investments has emerged as much more profitable, risk-free and simple than other investment option in Canada.

The Canadian media

Suspiciously, the Canadian media has published nothing on the CPP’s indisputable $271 billion surplus, equivalent to $2.71 trillion in the US. Several media authorities have stated the Canadian media has sacrificed their integrity for the sake of profit. For example, Chrystia Freeland, at one time a top journalist, claims

“the super-rich have bankrolled mass media outlets to dominate the debate over economic policy”.

It finally took a respected international publication to write about the CPP’s surplus. In January 2019, The Economist wrote

“Canada’s vast pension fund is gaining even more financial clout. The fund’s portfolio size has more than tripled over the past decade and is going to become only more gigantic.”

And since those words were published, the CPP’s surplus has increased by another $142 billion.

Where is our Canadian media? Has the lucrative financial industry paid them to remain silent regarding 17 million Canadian’s deserved surplus payment of $10,000 each?

The political parties

Any mainstream party could have gained, possibly, millions more votes if their platform included the following statement,

“The CPP has such a large surplus that we will be distributing $10,000, on average, to each of 17 million Canadians. There will be no danger to our grandchildren’s pensions. And we will also implement legislation that will possibly make, for example, a 25-year-old $1.4 million richer by age 65.”

This policy might have changed the outcome of the 2021 election because, to most Canadians, the promise of $10,000 will make even the apathetic get out and vote.

Political parties need funding help. Canada has had two elections in two years. Each party needs to pay for advertising, 330 riding’s expenses, thousands of signs, travel, consultants, and much more. And the pay-per-vote subsidy, worth roughly $25 million per party per election, was cancelled in 2015.

Have the tentacles of the wealthy financial industry also reached out to silence our political parties? To the financial industry, a few million dollars is insignificant if this investment can preserve their lucrative multibillion-dollar industry.

Democracywatch.ca, Canada’s democracy watchdog, states

“why do we allow wealthy private interests to buy politicians off with huge donations, including secret donations?”

In his book, Teardown Rebuilding Democracy from the Ground Up, Dave Meslin, Canada’s primary authority on the state of our democracy, states on page 124,

“Our political system has evolved into a sophisticated enabler of mass institutionalized bribery”.

Bribery in Canadian politics is not new. For example, in November 2015, the Charbonneau Commission revealed

“a system of bid-rigging that saw a cartel of engineering and construction firms obtain public contracts from the city of Montreal in exchange for political donations…In one instance the politicians requested $200,000, and Cadotte delivered $125,000 in cash to Liberal party fundraiser Bernard Trépanier, who stashed it in a briefcase.”

The Charbonneau Commission arguably revealed the biggest scandal in Canadian history. It cost Quebecers roughly $15 billion over five years.

With the Charbonneau Commission, the general government account lost $15 billion. With this CPP scandal, you, personally, and 17 million other deserving Canadians are losing $170 billion, $10,000 each, on average.

Finance Minister Chrystia Freeland has written PLUTOCRATS - The Rise of the NEW GLOBAL SUPER-RICH and the fall of EVERYONE ELSE outlining how our capitalist system is rigged to favour the rich. Mark Carney, at one time Governor of the Bank of Canada, has written a similar book. Probably for political reasons, they cannot be industry specific. This website can.

When 1% of our country can manipulate the system so that

17 million Canadians are being deprived of a deserved $10,000 each,

politicians ignore a method to double our GDP increase, create 200,000 jobs and reduce the deficit by $50 billion,

politicians ignore a sizeable solution to income inequality,

Canada is very far from a true democracy.

This website has much more convincing evidence that backs up all the above claims and much more.

To summarize:

Our CPP fund is now $271 billion above what is needed to fund our great grandchildren’s pensions

This is a 92% surplus. Some experts claim it is closer to a 464% surplus.

When a pension fund has a 25% surplus, it should be distributed

This means 17 million Canadians deserve $10,000 each, on average.

This $170 billion surplus distribution would double our GDP increase, create 200,000 jobs, and reduce the deficit by $50 billion.

Tragically, 50,000 low-income seniors are dying every year without seeing a penny of their deserved $10,000, which would likely ten-tuple their income left over after rent and day-to-day expenses. Two thirds, 33,000, are women

Income inequality could be somewhat solved. Almost all 25-year-olds would have $1.4 million by age 65 if the CPP just invested their first $2,000 in mandatory CPP contributions directly with CPP Investments.

Ten actuaries have denied the surplus with vacuous arguments because CPP Investments’ success is threatening their at-risk industry.

One actuary, with a conscience, has stated our Chief Actuary “Manipulates data, controls the narrative and hide things at will.” A professor of Finance who has studied the CPP for over five years concurs.

Our Chief Actuary has denied the $271 billion surplus.

The CPP has no representative Board of Governors even though actuaries recommend one for every pension fund.

The CPP is not audited by our Auditor General.

The only review of our Chief Actuary is a peer review. However, it has proven useless because “Actuaries are not allowed to criticize other actuaries”.

Chrystia Freeland and Mark Carney have written books that state our capitalist system is rigged to favour the rich.

With Toronto Financial International (TFI) members owning $10 trillion in assets, they are likely ten times bigger than any other organization in Canada.

TFI has stated they are worried CPP Investments could “undermine their retirement savings products”, which are inferior when compared to CPP Investments, the best pension fund investor in the world.

In her book, PLUTOCRATS, Ms. Freeland claims the “the super-rich have bankrolled mass media outlets to dominate the debate over economic policy”. Two other Canadian media experts agree.

The entire Canadian media has remained silent regarding a $271 billion CPP surplus, even though the CPP holds 10% of the lifetime earnings of most Canadians.

Only The Economist, a respected international publication, has alluded to the CPP’s “gigantic” fund, when the surplus in the fund was “only” $129 billion, not today’s $271 billion.

Any of the three mainstream political parties could have probably won the recent election with this risk-free platform that would benefit millions of Canadians but hurt TFI members.

Political experts agree that bribery is rampant in Canadian politics. Moreover, even though elections are very expensive, documented, legal donations received by each party are small.

The biggest scandal to date is the bribing of Quebec’s politicians regarding highway construction, resulting in the Charbonneau Commission. It indirectly cost Canadians $15 billion. This CPP scandal is directly costing Canadians $170 billion, $10,000 each, on average.

Only TFI has the resources and influence to engineer such a pervasive cover-up. They may be completely innocent of these allegations. However, the optics indicate they are likely guilty. Moreover, they are hypocrites because they have

“called for a more targeted approach to an expanded CPP, aimed at groups living below the poverty level and modest-income Canadians.”