Why millions of struggling Canadians are victims of what may be the biggest coverup in Canadian history

Based on nine years of research as a professor who taught The Mathematics of Finance, I have concluded that 99% of Canadians are victims of a coordinated, deliberate coverup—one that has transferred billions of dollars from ordinary citizens to Canada’s wealthiest 1%. This coverup is so severe that it may even lead to Alberta separating from Canada.

Here is how—and why—it happened.

Canada’s CPP Surplus: The Largest Concealed Windfall in Our History

For 15 years, CPP Investments has been the top-performing pension investor in the world. Because of this unmatched investment success, our $778-billion Canada Pension Plan (CPP) fund now sits at least $500 billion above what is required to pay all CPP benefits for current and future retirees.

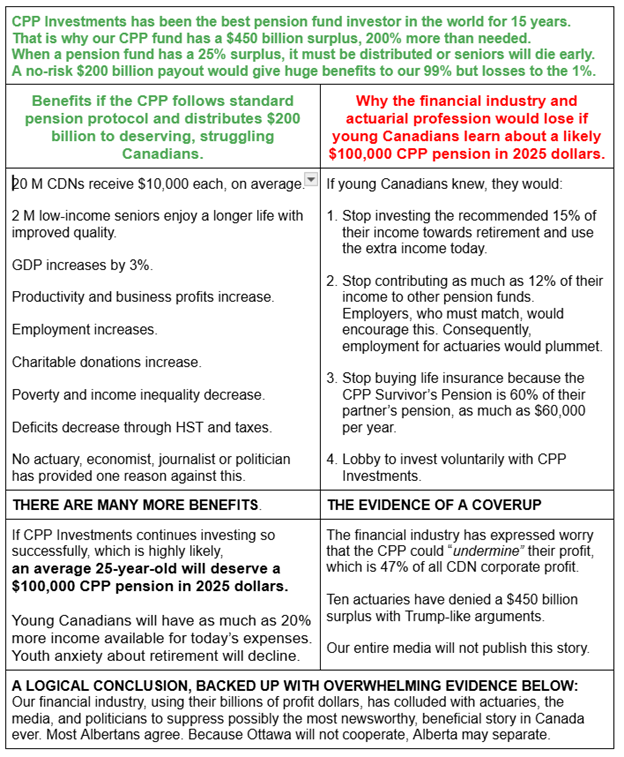

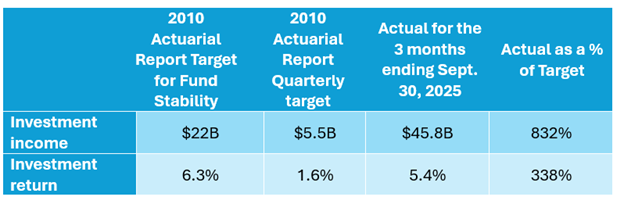

Consider the most recent data. For the three months ending September 30, 2025, CPP Investments achieved a 5.4% return on investment, equivalent to 21.6 % on an annual basis. In dollar amounts, they achieved a $46 billion return when only a $6 billion return is needed to fund all future pensions, as shown below.

In practical terms, this means 23 million Canadians have an extra $25,000 in their personal CPP account—money far beyond what is needed to fund their pensions.

The CPP’s surplus is now an astonishing 200%. Standard pension practice is clear:

at a 25% surplus, a distribution must occur.

This is exactly what happened at Ryerson University in 2000, when an 18% surplus prompted the CRA to order a surplus refund. Professors (myself included) received payments up to $20,000.

Yet the CPP—at 200% surplus—has distributed nothing.

Canadians Are Struggling While Their Money Sits Unused

A recent study found that 43% of Canadians are within $200 of insolvency. This is not a statistic—it is a national emergency.

Moreover, if the surplus had been disclosed and distributed as required, the one million low-income seniors who have died since 2016 would have received a deserved $10,000 payment. Research is unequivocal: Higher income increases longevity. These struggling seniors died earlier, poorer, and with less dignity than they deserved. And another 100,000 will die this year, never receiving their deserved $10,000.

A no-risk $200-billion surplus distribution today would give 20 million Canadians $10,000 each, on average, and dramatically improve Canada’s:

GDP

Productivity

Business profits

Employment

Income inequality

Poverty

Charitable giving

The mounting deficit

Every major economic indicator would improve. So why hasn’t this happened?

Because three powerful industries would lose billions if the truth became public.

1. The Financial Industry: Protecting Billions in Profit

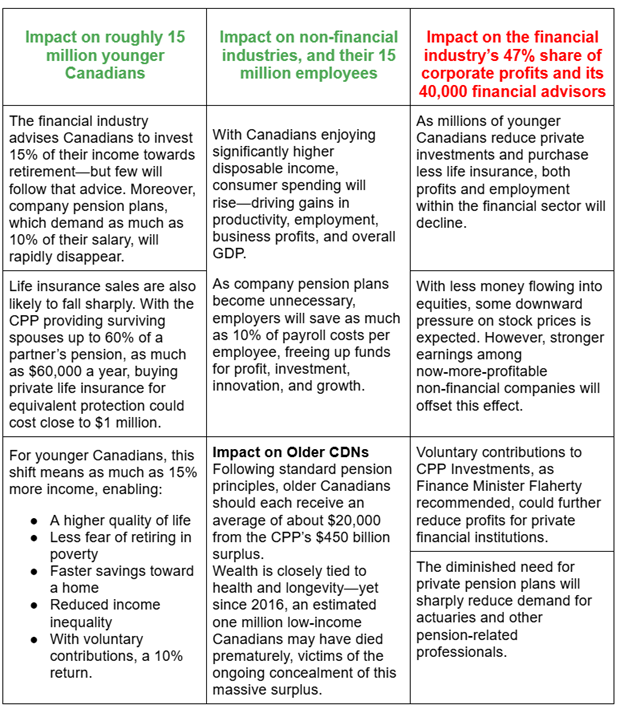

If Canadians understood the magnitude of the CPP’s surplus—and the CPP’s future earning power—the financial industry would face an existential threat.

Because CPP Investments has many advantages over the average investor, they are recognized as the best pension fund investor in the world. For the last 15 years, they have averaged a 10% return when only a 6% return is needed to fund all pensions.

Here is the problem facing the financial industry.

If CPP Investments continues achieving a 10% return, which is likely, the CPP can give 25-year-olds a $100,000/year CPP pension in 2025 dollars.

If young Canadians knew this, they would:

Stop investing 15% of their income towards retirement

Stop contributing to other pension plans

Stop buying life insurance, since the CPP pays a 60% survivor pension—worth ~$60,000 per year

Demand voluntary contributions to CPP Investments, a policy that Finance Minister Flaherty investigated in 2011

Enjoy more disposable income and less financial anxiety.

The industry’s lucrative business model will collapse if Canadians rely primarily on the CPP for retirement. The industry’s panic is understandable.

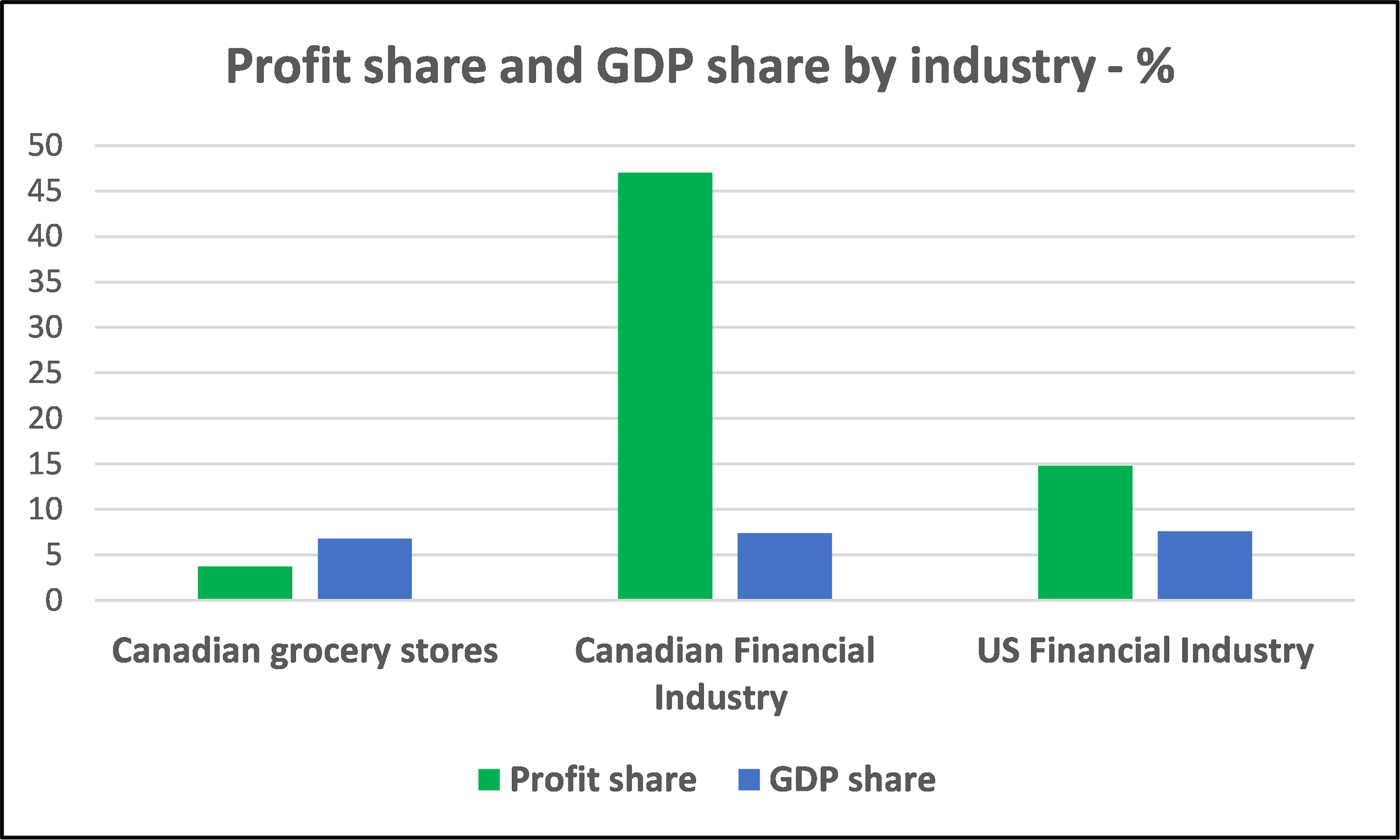

How wealthy is the industry? It currently captures 47% of all corporate profits in Canada but only contributes 7.5% to our anemic GDP. For comparison, in the US, the financial industry collects 25-30% of all corporate profit.

On December 5, 2025, in an article entitled “Higher profits pushed bankers bonuses higher in 2025”, the Globe and Mail reported that Canada’s Big Six banks alone awarded $27 billion in executive bonuses—an estimated $1.8 million, on average, for 1,500 executives. Meanwhile, millions of seniors live near poverty.

It is not just bank executives who are earning millions. Three individuals I knew from the 1970s, who joined the financial sector, now have a net worth estimated at $100 million each. Only one ever worked for a bank.

The industry is drowning in cash—and determined to protect it.

This explains why, in 2016, when Finance Minister Bill Morneau announced modest CPP changes, Janet Ecker of the Toronto Financial Services Alliance expressed relief. She feared significant CPP reforms like voluntary contributions could:

"Undermine a lot of successful, legitimate, (retirement savings) products in the investment industry."

But who should be “undermined”?

Should it be an industry that captures 47% of all Canadian corporate profits, largely for its own benefit?

Or should it be the millions of Canadians struggling to save for retirement?

2. The Actuarial Profession: Afraid of Obsolescence

If the CPP becomes the primary pension vehicle for Canadians—as it should—

the demand for actuaries will collapse.

Canadians have contributed roughly 10% of their lifetime earnings to the CPP (including our employer’s obligation to match on our behalf). That means, eventually, we will have each entrusted hundreds of thousands of our dollars to our Chief Actuary. Instead of being our watchdog, he has betrayed us.

Here is the entire problem in one example:

If, for example, at age 40, you had contributed $100,000 to the CPP 15 years ago, at the recommended 6% return, that $100,000 would be worth $218,000 today. At CPP Investments’ 10% return, that $100,000 is worth $418,000 today. That’s a $200,000 surplus in one person’s account.

Multiply that across the population and the CPP’s surplus becomes $500 billion. Actuaries should have shouted this from the rooftops. Instead, they buried it.

Of the ten top actuaries I consulted, they all denied a surplus existed—using arguments so weak they bordered on incoherent. One retired actuary, with a conscience, finally admitted:

“Our Chief Actuary has done what pension actuaries frequently do - invent measures that are easily manipulated so that actuaries can control the narrative and hide things at will...I must remain anonymous because I am not allowed to criticize my fellow actuaries.”

This is the profession tasked with safeguarding our nation’s retirement security.

3. The Mainstream Media: Silent, Complicit, Controlled

Is there a more important story in this country than:

CPP’s $500 billion surplus can help millions of struggling Canadians

Based on standard pension practice, the CPP’s $500 billion surplus should be distributed. A no-risk $200 billion surplus distribution would give 20 million Canadians $10,000 each, on average. It would also lead to considerable improvements in Canada’s GDP, productivity, employment, business profits, poverty, income inequality, charitable donations and deficit. A recent study indicates 43% of Canadians are within $200 of insolvency. A deserved $10,000 payment would be life-changing.

Moreover, young Canadians no longer need to invest for retirement, buy life insurance or contribute to other pension plans. This is because the CPP will likely give them a $100,000 CPP pension, in 2025 dollars.

With as much as 15% more income available and news of a secure retirement, young Canadians can shed much of their current anxiety and improve their quality of life. However, the financial industry and actuarial profession would suffer.

Yet the entire mainstream media has refused to publish even the first paragraph of this reality. Two journalists who pushed the issue lost their jobs. In nine years, not once has the phrase “CPP surplus” appeared in mainstream media.

Even the CBC refuses to report it. The CBC answers only to one man: Mark Carney, who has used the CBC to impose a total blackout on the surplus.

Democracy is non-existent on this crucial issue. Any party could likely win a majority if they promised to give 20 million Canadians $10,000 each. However, almost all MPs and MPPs refuse to acknowledge the surplus, thanks to some very persuasive “influence” from our financial industry. On this crucial issue, instead of:

Government of the people by the people for the people,

Canadians are receiving

Government of the people by the financial industry for the financial industry.

How This Coverup May Cause Alberta to Leave Canada

Premier Danielle Smith is the only senior politician refusing to participate in this deception. She has demanded Alberta’s fair share of the CPP: $130 billion, of which $65 billion is surplus. Using it, she plans to:

Fully cover all CPP pension obligations

Give Alberta seniors up to $10,000 each

Reduce contributions by $1,425 per worker (and matching employer) annually

Invest some of the remaining funds in Alberta’s economy.

In 2023, she hired Lifeworks to calculate Alberta’s share. They produced an absurd 53% figure—clearly designed to sabotage the case. The media then attacked her for Lifeworks’ inflated number, painting her as irrational and un-Canadian.

The above graphic is from CARP’s website. Even though CARP is seniors’ most influential advocate, CARP joined the attack, thereby depriving senior Canadians of the $60 billion that is rightfully theirs. Several other organizations with an admirable mandate have similarly abandoned those who they (allegedly) serve.

Albertans have figured out the truth. And they are angry. Ottawa’s refusal to return Alberta’s rightful share—combined with a suppressed surplus—may push Alberta toward separation.

Mr. Carney’s pipeline MOU does not matter when Albertans, most struggling, are each being denied their needed $10,000 surplus payment.

The perpetrators are growing desperate. They understand that if Albertans receive these benefits, struggling Canadians in every other province will immediately demand their own $10,000 share. They also know that once young Canadians realize they no longer need to pour up to 15% of their income into private retirement products, the financial industry’s grip will collapse. Even with a coordinated media blackout, the truth will spread—by word-of-mouth, by social media, and by sheer outrage: every Canadian is owed roughly $10,000, and young Canadians are on track to receive a likely $100,000 CPP pension. The coverup cannot hold much longer.

The Reverse Order of Canada List: Exposing Those Most Responsible

For seven years, I have contacted thousands of influential Canadians—politicians, economists, executives, journalists—urging them to expose this injustice. Almost none responded.

So I created The Reverse Order of Canada List. It is a list of those who have intentionally deprived millions of Canadians of billions of deserved dollars, and more.

Suddenly, doors opened. When told they belonged near the top of the list:

Professor Trevor Tombe, a one-time writer for wealthy-funded think tanks, reversed his position after being informed he belonged near the top of the list. He now sits beside Premier Smith in Town Hall Meetings, publicly supporting an Alberta Pension Plan.

CARP finally responded after ignoring ten emails. They claim they will talk to our Minister of Finance.

CBC executives have begun investigating their blackout after being confronted and accused of denying Canadians their Charter Rights.

Kristen Underwood, Director General of Seniors Policy, issued a feeble defence that only confirmed her office’s complicity.

The List is working. Time will tell.

Why the Upcoming Book Will Matter

My upcoming book on the CPP may be a bestseller because it will:

Expose what may be the largest coverup in Canadian history

Mobilize millions of Canadians to demand the surplus owed to them

Explain why Alberta is moving toward separation

Include The Reverse Order of Canada List.

This issue will not go away. The truth is out.

A Summary: How and why Canada’s 99% are being deprived of billions of deserved dollars

Impact if Canadians learn the CPP will likely give a 25-year-old a $100,000 CPP pension in today’s dollars

Proof of the CPP’s surplus

For readers seeking direct proof of the CPP’s surplus, the following will make it unmistakable. First is the Chief Actuary’s 25th Actuarial Report from 2010. Beneath it is the CPP Investments website as of December 2025. The surplus began accumulating immediately after 2010, yet every actuarial report since has used increasingly opaque methods to bury—rather than reveal—the excess. As one senior actuary admitted, the Chief Actuary has “controlled the narrative and hidden things at will.”

The three arrows above show the following:

The red arrow from the red $347B (Billion) box to the $777.5B value shows that our Chief Actuary specified he needed a $347B value on Jan. 1, 2025 and the actual value on Sept. 30, 2025 was $777.5B. This $347 billion estimate has been calculated after taking into account all factors that influence pension fund stability - investment return, employment, immigration, inflation, and mortality. Aside from investment return, our Chief Actuary’s estimate has been very accurate in predicting these factors.

The red arrow from the big box, averaging 6.1%, to the 5.4% return for the quarter, shows that, for the most recent quarter available, CPP Investments had a 21.6% return on an annual basis.

The green arrow shows the Chief Actuary specified a $22B return for the year or $5.5B for the quarter. The actual return for the quarter was $45.8B, resulting in a $40.3B surplus for the quarter and an overall surplus of $431 billion.

For perspective,

To summarize, in the three months ending September 30, 2025, our CPP fund increased by $40.3 billion more than needed. Because CPP Investments has averaged a 10% return since 2010, actuaries should forecast presuming a higher return than 6.3%. This means the fund needs a lower value than $347 billion for fund stability. The true surplus is therefore roughly 200% above target.

This single quarter’s $40 billion surplus is equal to or greater than the entire federal deficit in many ordinary years. If that much money can be hidden in a pension fund, it shows just how large the surplus really is — and how feasible a large CPP distribution would be, without “breaking the bank.”

Global SWF is a New York-based pension industry specialist. They recently analyzed all Public Pension Funds, worldwide. Below shows that CPP Investments, the best pension fund investor in the world, averaged a 10.9% return for the 10 years ending in 2022.

Because CPP data changes every quarter, only the information shown above is fully up-to-date. Any menu items above should be viewed with caution, as their figures may no longer reflect current realities.

The following is not up-to-date.

Compelling Evidence of Collusion Among Three Industries to Enrich the Top 1% at the Expense of the 99%

The following provides specifics of an insidious cover-up that is depriving 99% of Canadians of a deserved $200 billion, and much more. For credibility, four top politicians have responded or acted based on the details below.

Premier Danielle Smith has grounded her demand for Alberta’s $130 billion share of the $777 billion CPP fund on the research summarized below. Of that $130 billion, approximately $65 billion represents surplus. Using this surplus, she will:

Provide every Alberta senior with up to $10,000

Reduce CPP contribution amounts by $1,425 per employee and per employer each year

Invest the remaining $115 billion in profitable, made-in-Alberta projects

Because Ottawa, the media, and the actuarial community continue to block any discussion of a national CPP surplus distribution, frustration in Alberta is escalating. For many residents, a memorandum of understanding about a pipeline pales in comparison to receiving a deserved $10,000 payment—especially during a period of economic strain.

As these roadblocks persist, Alberta’s movement toward separation continues to grow.

On December 4, 2025, Kristen Underwood, Canada’s, Director General, Seniors and Pension Policy Secretariat, emailed a pathetic defence when accused of depriving Canadian seniors of a deserved $60 billion, based on standard pension practice.

Pierre Poilievre, in his email below, called the following recommendation “a new and innovative idea to rescue our economy.”

Finance Minister Freeland unsuccessfully attempted to refute my findings.

Finance Minister Morneau used my research, which uncovered a 76% Guaranteed Income Supplement (GIS) clawback to alter GIS legislation. Low-income seniors now receive $440 million more per year in GIS payments.

As a professor emeritus (Business), I have studied the CPP for nine years. Because CPP Investments has been declared the best pension fund investor in the world, our CPP fund now has an irrefutable $500 billion surplus. Based on standard pension practice, roughly $200 billion should be distributed. Such a surplus distribution would give 20 million Canadians $10,000 each, increase our anemic GDP by 3%, increase business profits by 20%, reduce our deficit by $50 billion, help solve income inequality and much more.

However, the financial industry, the actuarial industry and the media industry would lose if the news of the CPP’s surplus became known. The evidence below is convincing that these three industries have rigged our capitalist system to suppress the news of the CPP’s surplus and potential.

Several Experts and Icons Recommend Suspicion and Vigilance.

To make these disturbing allegations more credible, below are warnings from several prominent Canadians. They state that, under-the-radar, selfish powers are defying democracy so they can become even wealthier.

In her book, PLUTOCRATS, Finance Minister Chrystia Freeland highlights the prevalence of elite attempts to use political influence for personal gain, stating,

“In an age of super-wealth, we need to be constantly alerted to efforts by the elite to get rich by using their political muscle to increase their share of the pre-existing pie, rather than adding value to the economy and thus increasing the size of the pie overall.”

Mark Carney, candidate for Liberal leadership, echoes these concerns in his book VALUE(S), describing Canadians as victims of

"Twisted economics, an accompanying amoral culture, and degraded institutions whose lack of accountability and integrity accelerate the system’s dysfunction."

Pierre Poilievre asserts that "Our system is broken.” and “Fire the gatekeepers.", probably alluding to our complicit Chief Actuary and the complicit President of the CBC.

David Meslin, Canada's foremost expert on democracy, in his book "TEARDOWN," states,

“Our political system has evolved into a sophisticated enabler of mass institutionalized bribery... powerful corporations continue to wield enormous power in our legislatures.”

Duff Conacher of Democracywatch.ca emphasizes the significant financial impact of corporate cash, stating,

"Corporations spend $25 billion annually on their lobbying and promotion efforts."

If capitalism is so suspect, what specific companies or industries are “using their political muscle to increase their share of the pre-existing pie?”

It is probably not those companies that provide goods or services. The law of supply and demand keeps them somewhat profitable. Walmart and Costco are excellent examples.

However, consider Canada’s mysterious financial industry. They earn 47% of all corporate profits in Canada but only contribute 7.4% to our anemic GDP. In 2020, their profit was a whopping $125 billion, aka $125,000 million. For comparison, the US financial industry, led by Wall Street, only earns 22% of all corporate profits in the US.

The following shows how Canada’s financial industry has managed to “use their political muscle” to deprive millions of Canadians of billions of deserved dollars.

Why our CPP has a huge surplus.

My second cousin, John MacNaughton, was CEO of CPP Investments from 1999 to 2004. Up until 1999, the fund was composed of mostly low risk bonds and guaranteed income certificates (GICs). John spearheaded a move to invest in riskier investments, including stocks, private equity, real estate, infrastructure and much more, worldwide. This change in investment strategy has generated very large profits for the 22 million members of the CPP, at very little risk. John’s initial investment strategy has resulted in CPP Investments being able to state in a recent Globe and Mail advertisement that they have had “the highest returns of any global pension fund. Period.”

In 2010, our Chief Actuary stated he needs a CPP fund value of $347 billion on January 1, 2025 in order to fund all pensions for 75 years. Thanks to the outstanding success of CPP Investments, the fund value on Sept 30, 2025 was $777 billion, meaning our CPP fund now has a surplus of roughly $430 billion. Moreover, if we forecast using CPP Investments’ 15-year return averaging 10%, as pension experts recommend, the surplus becomes $500 billion. This means our CPP fund now has a 200% surplus.

What about the other factors that actuaries use to determine a surplus? Consider their predictions for mortality, fertility, inflation, net migration, unemployment, participation, GDP and number of disability recipients. Since 2010, these factors combined have resulted in the fund now having $18 billion more than predicted. This is another reason that justifies declaring a surplus.

CPP Investments had outstanding success for the three months ending Sept. 30, 2025, as shown below.

The three arrows above show the following:

The red arrow from the red $347B box to the $777.5B value shows that our Chief Actuary specified he needed a $347B value on Jan. 1, 2025 and the actual value on Sept. 30, 2025 was $777.5B.

The red arrow from the big box, averaging 6.3%, to the 5.4% return for the quarter, is equivalent to 21.6% on annual basis.

The green arrow shows the Chief Actuary specified a $22B return for the year or $5.5B for the quarter. The actual return for the quarter was $45.8B, resulting in a $40.3B surplus for the quarter and an overall surplus of $431 billion.

For perspective,

To summarize, in the three months ending September 30, 2025, our CPP fund increased by $40.3 billion more than needed, resulting in a 124% surplus. Because CPP Investments has averaged a 10% return since 2010, actuaries forecast using a higher return, resulting in a lower needed today for fund stability. The true surplus is therefore roughly 200% above target.

he top image expected an investment return averaging roughly 6.3% per year (in the large red box). Global SWF is a New York-based pension industry specialist. They recently analyzed all Public Pension Funds, worldwide. Below shows that CPP Investments, the best pension fund investor in the world, averaged a 10.9% return for the 10 years ending in 2022.

The power of compound interest is large. For example, investing $1,000 at our Chief Actuary’s specified 6.3% return yields $1,842 in 10 years. Investing $1,000 at CPP Investments’ 10.9% return yields $2,814 in 10 years, resulting in over two times the investment return.

Who owns this $400 billion surplus? Because CPP Investments used Canadians’ money to accumulate this return, based on standard pension practice, this surplus belongs to all contributors to the CPP.

How much would you receive from a surplus distribution? It depends on how much of your contributions were used to accumulate the surplus. For example, a younger Canadian, because he has contributed less, would receive less from the surplus. Conversely, a 55-year-old Canadian in 2010, when the surplus started accumulating, may have had $100,000 in the fund. He would receive much more.

CPP Investments is proud of their outstanding ability to invest our CPP contributions with success better than any other pension fund in the world. The following graph was recently published in various Canadian media, as a paid advertisement.

The graph below shows how our CPP fund has evolved from being perfectly balanced in 2010 to a $322 billion surplus today.

Forecasting using CPP Investments’ likely ongoing 10.9% return, as pension experts recommend, we only need roughly $200 billion in the fund today to meet all future commitments. This means the fund is 338% funded and has a $475 billion or 238% surplus. When a pension fund has a mere 25% surplus, a surplus distribution is recommended. That is why, in 2000, when the Ryerson University Pension Plan had a mere 18% surplus, the CRA demanded a surplus distribution. Professors, including me, received as much as $20,000 each.

Consider the benefits or a recommended $200 billion surplus distribution:

Twenty million Canadians would receive $10,000 each, on average,

Business profits would increase by 20%,

Our GDP would increase by roughly 6%, because of the multiplier effect ($200 billion is 6.7% of our GDP),

Employment would increase,

Charitable donations would increase,

Poverty would decrease,

Income inequality would decrease,

Our troubling deficit would decrease by roughly $50 billion, thanks to increased income tax and HST,

The 100,000 low-income seniors who will die this year could enjoy increased longevity and improved quality of life with their deserved $10,000,

CPP Investments could sell off its poorly performing investments, thereby increasing its overall return to 15%, for example,

Several other positive outcomes.

No actuary, economist, politician, or journalist has provided one reason to NOT distribute the CPP’s surplus.

Still more benefits

We all have a personal fund within the CPP’s giant fund. Presuming a 10.9% return, consider a 25-year-old earning, for example, $50,000 today. Here is how his personal fund would grow.

With $3.2 million in his personal fund at age 65, presuming an ongoing 10.9% return, using the investment income only, he could enjoy a $350,000 CPP pension. He could leave the principal of $3.2 million for an emergency or for his family when he passes on.

What about inflation? Based on a 2% inflation rate over 40 years, $350,000 becomes $160,000 in 2025 dollars. Based on a 3% inflation rate over 40 years, $350,000 becomes $107,000 in 2025 dollars.

(For advanced analysts, this analysis accounts for the fact the CPP is a pay-as-you-go pension plan and presumes the CPP’s $400 billion surplus will be distributed today.)

Ongoing high returns for CPP Investments are probable. They have many investment advantages over the average investor. For example, their private equity investments, constituting one-third of their $675 billion portfolio, recently achieved an unprecedented 33.2% return, as shown in their Annual Report 2022 (Page 43).

Why the Financial Industry has spent millions to suppress the news of the CPP’s surplus

One would naturally think, as I did six years ago, that the financial industry would want these numerous, considerable benefits reaching millions of Canadians and our sputtering economy. However, the reverse is true. The following explains why.

The financial industry recommends Canadians invest 15% of their income towards retirement. Canadians are listening. We now have $4 trillion invested in RRSPs and TFSAs alone. This is $100,000, on average, for each of 40 million Canadians. At an estimated 1% charge for investment advice, the financial industry earns $40 billion per year on RRSPs and TFSAs alone. Because there are maximums on RRSP and TFSA accounts, Canadians may have an estimated second $4 trillion also invested with the financial industry.

It was probably intense lobbying by the financial industry that led to the developments in of RRSPs and TFSAs'. They tax avoidance investment alternatives have provided a win/win for both Canadians and our financial industry, in the short run. However, Canadians will eventually pay because these policies have resulted in a large decline in tax collection, thereby contributing to our spiraling debt.

Conversely, the news of the CPP’s surplus would lead to a win/lose for Canadians and our financial industry. Not only is there zero lobbying for a CPP surplus distribution, three greedy industries have colluded to conceal the most newsworthy, most impactful story in Canada in years.

However, if young Canadians knew a $100,000 in 2025 dollars CPP pension likely awaits them, their desire to invest 15% of their income towards retirement would plummet. Many, now struggling financially, would use their additional 15% in income to improve their quality of life today. The financial industry would then lose billions of dollars in investment fees, annually. Moreover, some Canadians might even cash in their RRSPs and TFSAs now, instead of waiting until age 65.

Moreover, when a member of the CPP dies, his surviving spouse receives a pension that is roughly 60% of her partner’s pension. With a probable $100,000 CPP pension at age 65, and a portion of a spouse’s pension available, life insurance becomes unnecessary, resulting in a big decline in a second moneymaker in the financial industry.

The Case for Voluntary Contributions to CPP Investments

The financial industry has a multibillion dollar reason to fear the idea of voluntary contributions to CPP Investments - they cannot compete. The idea is not outlandish—Canada's former Finance Minister, Jim Flaherty, explored this concept in 2011. However, he faced a deluge of misinformation and relentless lobbying from the financial sector, which derailed the initiative. Sadly, Mr. Flaherty, likely one of the few Finance Ministers capable of challenging the powerful financial industry, passed away in 2014 at just 64 years old.

Looking ahead, there is hope for reform. In January 2025, Pierre Poilievre, with his firm stance of "never listening to lobbyists," could soon legislate voluntary contributions. This is an idea that would resonate with the vast majority of Canadians, as explained below.

The Astonishing Power of Compound Interest

Compound interest, described as one of the most powerful forces in finance, is a concept that even Albert Einstein reportedly praised:

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it."

To understand how voluntary contributions to CPP Investments and compound interest could benefit Canadians, consider the case of a 25-year-old who aims for a retirement income of $50,000 per year (indexed), beginning at age 65 and lasting through his expected lifespan to age 85.

Two Investment Scenarios

Self-Investing:

Following the financial industry’s common recommendation of a 60/40 portfolio split (60% equities, 40% fixed income), the investor might expect an average annual return of 4.4% after fees.

To achieve his goal, the individual would need to contribute $6,000 per year over 40 years, $240,000 in total, to collect $1 million over 20 years in retirement.

Few 25-year-old Canadians can contribute an extra $6,000 without seriously hampering their quality of life.

2. Voluntary Contributions to CPP Investments:

CPP Investments has averaged a 10% annual return for 15 years. This outstanding return will likely continue.

Under this scenario, the individual would only need to contribute $1,000 per year over 40 years, $40,000 in total, to collect the same $1 million over 20 years in retirement.

Because of the potential benefits, most 25-year-olds would make the slight $1,000 per year sacrifice because of the huge benefits available.

The difference is staggering: by utilizing CPP Investments, the investor requires just one-sixth of the annual contribution to achieve the same outcome.

The Impact Over Time

The graph below illustrates the dramatic difference in portfolio growth between these two approaches.

By leveraging a Tax-Free Savings Account (TFSA), the $50,000 annual retirement income would be tax-free. However, inflation would reduce its future buying power to roughly $23,000 in today’s dollars. Supplementary income sources, such as Old Age Security (OAS) of approximately $9,000 per year and up to $23,000 from the CPP, would bring his total tax-free income at age 65 to roughly $50,000 annually, in 2025 dollars.

The Stark Contrast

This comparison reveals a stark difference:

Self-investing requires six times the contributions of investing through CPP Investments.

Voluntary contributions could enable Canadians to achieve the same retirement income with far less effort and financial burden.

This explains why, in 2016, when Finance Minister Bill Morneau announced modest CPP changes, Janet Ecker of the Toronto Financial Services Alliance expressed relief. She feared significant CPP reforms like voluntary contributions could:

"Undermine a lot of successful, legitimate, (retirement savings) products in the investment industry."

But who should be “undermined”?

Should it be an industry that captures 47% of all Canadian corporate profits, largely for its own benefit?

Or should it be the millions of Canadians struggling to save for retirement?

A Personal Example

Consider three university associates who joined the financial industry after graduation. Their wealth is now estimated at $100 million each. Meanwhile, ordinary Canadians are left to navigate the financial industry’s high fees and subpar returns, coupled with a pathetic, deceptive Chief Actuary to watch over our CPP contributions, 10% of our earnings, lifetime.

Could CPP Investments handle Voluntary Contributions?

If Canadians could contribute up to $1,000 annually to CPP Investments, the program would not be overwhelmed. For example, if 10 million Canadians opted for the maximum contribution, the total investment would be $10 billion per year—a manageable figure for a fund now valued at roughly $700 billion.

Moreover, the CPP currently holds a $400 billion surplus, of which $200 billion should be distributed under standard pension practices. Allowing voluntary contributions would provide CPP Investments with additional capital to offset a deserved CPP surplus distribution.

Conclusion

The financial industry cannot compete with CPP Investments’ proven track record of 10% annual returns. Voluntary contributions would give Canadians six times the value compared to traditional investment options. If made available, voluntary contributions would likely become a transformative solution for Canada’s retirement system, empowering millions while challenging the dominance of the financial sector. It would also substantially reduce skyrocketing Guaranteed Income Supplement (GIS) payments.

Canadians Deserve Better: The Case for Voluntary Contributions to CPP Investments

By coincidence, our CPP gives us the same return on our contributions as self-investing does - 4.4%. With as much as $7,500 contributed in 2025, if our contributions directly received CPP Investments’ 10% return, a 25-year-old would have a $375,000 CPP pension in 40 years, equivalent to a $169,000 pension in 2025 dollars. If we transformed the CPP into a Defined Contribution (DC) plan instead of a Defined Benefit (DB) plan, Canadians would receive six times the CPP pension.

Because of our Chief Actuary’s failure to acknowledge the CPP’s $400 billion surplus, Canadians will continue to receive a 4.4% return on their contributions. Meanwhile, CPP Investments will continue to use their contributions to achieve a 10% return.

A Hybrid Model: The Best of Both Worlds

A compromise is possible:

For example, half of contributions could be treated as DC, likely yielding a $85,000 pension (in 2025 dollars) in retirement for young Canadians.

The other half of contributions would be more than enough to meet current pension promises. They could remain in the DB system.

Younger Canadians are now struggling with anxiety and depression. As they , watch their contributions grow exponentially, they would no longer feel pressured by the financial industry’s ominous warnings:

"Invest 15% of your income for retirement—or face poverty in old age."

Instead, they could enjoy as much as 15% more income today, with greater peace of mind, anticipating a likely $85,000 CPP pension (in 2025 dollars).

A Government Agency That Excels

Most Canadians agree that some essential services are most effective when overseen by the government. For instance, Universal Healthcare, The Military, and Education are probably all more effective because our government oversees them. However, government agencies often have a reputation for inefficiency, high costs, bureaucratic red tape, inconsistent goals, and poor service delivery.

In Canada’s history, have any government agencies achieved the level of success demonstrated by CPP Investments, widely regarded as the best pension fund investor in the world? Its stellar performance raises an important question:

Why can’t Canadians benefit directly from this one government agency that excels? Why must we contribute six times as much elsewhere to achieve the same retirement income CPP Investments could give us?

This failure has had devastating consequences: one million low-income seniors have died prematurely over the past decade, living shorter lives of reduced quality. Meanwhile, Canadians continue to see returns of just 4.4% on their CPP contributions, despite the outstanding 10% investment performance of CPP Investments.

Confronting Industry Greed

Canadians should not continue to subsidize an industry that prioritizes its profits over their well-being. It’s time to combat this greed and demand better. Any politician who opposes voluntary contributions to CPP Investments owes Canadians an explanation. If they cannot provide one—and even Finance Minister Chrystia Freeland has attempted and failed to do so—then they must acknowledge their allegiance to the financial and actuarial industries over the millions of struggling Canadians they are supposed to democratically represent.

The CPP’s surplus can help solve many other serious problems

Mental health has emerged as a big problem among Canada’s youth. Surveys indicate many fret about retirement security. The revelation that a $100,000 CPP pension likely awaits them, coupled with as much as 15% more income available today, could help bring peace of mind to millions of young, anxious, struggling Canadians. For some, this 15% increase in income could even pave the way for a down payment on a home.

Canada’s sputtering economy would also improve. If Canadians had as much as 15% more income available to spend, and they received a surplus payment of $10,000, our anemic GDP and business profits would increase substantially, resulting in more income tax and HST revenue. The problems of our spiraling deficit and sluggish GDP would then be substantially addressed.

Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) now cost our federal government a whopping $78 billion per year, 17% of all federal expenses. They are scheduled to skyrocket at a rate of 5% per year to 2035. If most Canadians eventually receive a $100,000 CPP pension in 2025 dollars, this mushrooming expenditure could decline considerably.

Finally, expensive contributions to other pension plans could stop. Currently employees contribute as much as $10,000 per year per employee, matched by the employer, towards a pension plan. With the CPP likely providing a $100,000 pension, this cost to both employees and employers could be reduced substantially.

How could so many benefits not reach struggling Canadians?

The above shows that the financial industry has the motivation to suppress the news of the CPP’s surplus. The news could likely result in billions of dollars in lost profit, per year. But do they have the resources? Absolutely. In 2020, for example, they earned a massive $125 billion in profit. For clarification, most Canadians understand $1 million is big. The financial industry earns 125,000 times $1 million every year.

The evidence below is convincing that the financial industry has invested, for example, a mere 1% of their profit, a very convincing $1.25 billion to subtly and illegally suppress the news of the CPP’s surplus. They have done this so that they can continue to collect huge profits from millions of Canadians who have been duped into thinking they need to invest substantially now or experience a retirement in poverty.

The wealthy already have advantages

Few Canadians realize that, in the 1960’s, the top tax rate in Canada and the US was over 90%. Then, likely using bribery, the wealthy managed to decrease that rate to roughly 53% in Canada and 40% in the US.

Moreover, in Canada, 47 of 51 tax loopholes favour the rich. The wealthy already have huge advantages. This insidious CPP surplus cover-up, orchestrated by the greedy wealthy, needs to be stopped.

On this crucial issue, Democracy has vanished

Democracy expert David Meslin’s statement in his book "TEARDOWN: Rebuilding Democracy from the Ground Up” is telling. He wrote:

“Our political system has evolved into a sophisticated enabler of mass institutionalized bribery... powerful corporations continue to wield enormous power in our legislatures.”

Even the NDP could potentially secure a landslide majority by merely promising to give $10,000 to each of 20 million Canadians, let alone the other benefits alluded to earlier. So, why haven't they? Did the financial industry strike this example bargain with all three political parties:

"If you never mention the CPP’s surplus, we will give your party $50 million per year"?

This would explain why all politicians remain mute regarding the CPP’s surplus, even though all 334 MPs have received these details, twice, in the last five years. They all act as if they have signed some NDA that silences any discussion of the CPP’s surplus. Only Mr. Poilievre, who has stated “Our system is broken.” and “Fire the gatekeepers.” has responded, as shown below. My principled MP, Jane Philpott, upon learning of these details, stated “Disgraceful lobbyists.”

Alberta Premier Danielle Smith wants no part of this bribery. She has demanded Alberta receive its fair share of our CPP fund so that she can give Albertans the numerous benefits described above.

The Canadian Media is Obviously Complicit.

Consider the landscape of our Canadian media over the past two decades. Can you recall a story more significant and impactful for Canadians than the following:

"Adhering to standard pension practice, the CPP should now distribute $200 billion of its $400 billion surplus to deserving Canadians, with no risk to future CPP pensions. The potential benefits are vast, including 17 million Canadians receiving $10,000 each, a 20% increase in business profits, a 3% GDP boost, heightened employment, reduced poverty, reduced income inequality, a deficit reduction of $50 billion, and much more.

Because CPP Investments has many advantages over the average investor, it is likely they will continue investing so successfully. If so, an average 25-year-old could have a $100,000 CPP pension in 2025 dollars. This means he can stop investing now towards retirement and use his additional income to improve his current quality of life."

If such a story were published, politicians would be forced by protesting Canadians to legislate CPP changes so that millions of Canadians and our anemic Canadian economy could receive these benefits.

Canadians are starved for good news. After first struggling with Covid, most are now faced with high housing costs, unemployment, galloping inflation, mushrooming income inequality, climate change, crippling tariffs, and much more. It is criminal to deprive them of a deserved $10,000 and a virtually guaranteed high-income retirement.

Surprisingly, not one word on the CPP’s surplus has ever been published in Canada’s mainstream media. In contrast, in 2019, The Economist, the esteemed and unbiased international publication, stated:

"Canada’s vast pension fund is gaining even more financial clout. The fund’s portfolio size has more than tripled over the past decade and is going to become only more gigantic.”

Moreover, since those words were published, our "gigantic" CPP fund has expanded by another $300 billion.

Candid insights from Canadian media experts underscore the prevalence of bribery in the industry. John Miller, previously Managing Editor of the Toronto Star and Chair of Journalism at Ryerson University (aka TMU) has stated:

"The Canadian media is cannibalistic...They’re chewing away bone marrow of their own properties in order to make them a profit, so the whole public service aspect of journalism has taken a back seat. The overall quality of journalism has been lost."

Ex-world class journalist, Chrystia Freeland’s thoughts from her book PLUTOCRATS: The Rise of the New Global Super-Rich and the Fall of Everyone Else are:

"The super-rich have bankrolled a network of conservative think tanks, elite journals, and mass media outlets to dominate the debate over economic policy."

Mark Edge, Canadian journalist, academic and author. stated:

"Media owners don’t really care too much about journalism. It’s just a means to an end, and that end, of course, is making money."

Pierre Poilievre, likely Canada’s next Prime Minister, recently stated:

“We can’t count on the media to communicate our messages to Canadians. We have to go around them and their biased coverage.”

Mr. Poilievre constantly uses unbiased media like Youtube to convey his message to Canadians. He seldom speaks to the deceptive mainstream media.

The lengthy tentacles of the financial industry have even reached “our” CBC. Despite repeated submissions and shaming by me, executives at “our” CBC refuse to publish one word on the CPP’s surplus. This failure strongly justifies Mr. Poilievre’s threat to “Defund the CBC.” and “Fire the gatekeepers.”, probably alluding to the disgraceful president of the CBC.

Consider the ArriveCan APP. Our Canadian media has published an estimated 1,000 stories regarding this $60 million scandal. Meanwhile, our Canadian media has published zero stories on a scandal that is costing Canadians $200 billion, over 3,000 times the cost of the ArriveCan scandal. This further confirms media experts’ claim that our media has abandoned integrity for profit.

Instead of this highly impactful CPP surplus story, our media supplies us with a steady diet of stories that, financially, have virtually no impact on our day-to-day lives. The ArriveCan APP, the carbon tax, and foreign interference are the somewhat irrelevant stories that the media continued to bombard us with in 2024. Please compare any abuse you have personally encountered from these “scandals” compared to the abuse you are experiencing because you, and millions of other Canadians, are not receiving the CPP benefits described above.

The entire Canadian media, grappling to turn a profit, is controlled by a handful of questionable corporations, mostly within the financial industry. Did the financial industry orchestrate this example arrangement with all media owners?

“If you never mention the CPP’s surplus, we will give your company $50 million per year."

Appallingly, the few ethical journalists who have fought for this CPP surplus story are no longer employed. It appears that media owners will fire any journalists who have a conscience.

Compared to the US, most Canadians think we have a democratic country with an unbiased media that publishes all stories that are newsworthy. Because our media has collectively agreed to veto stories like the CPP’s surplus, our media is arguably worse than the US media.

The U.S. media landscape, with outlets like right-leaning FOX and left-leaning CNN, regularly presents opposing viewpoints, allowing citizens to consider multiple perspectives on critical issues. For example, a story as significant as Canada’s $400 billion CPP surplus (equivalent to $4 trillion in the US) would likely be published freely and then analyzed in depth in the U.S.

Actuaries Also Have Much to Lose.

If Canadians knew the CPP will likely give them as much as a $100,000 pension in 2025 dollars, few would contribute to any other pension plan. Then the need for actuaries, the watchdogs of pension plans, would plummet. This explains why the ten top Canadian actuaries who I have consulted have all denied the CPP’s $400 billion surplus with vacuous arguments.

Canada’s Chief Actuary oversees 10% of the lifetime earnings of most Canadians, totaling trillions of dollars. However, he operates without oversight. There are three oversight options that, on behalf of millions of Canadians, could check on the reporting of our Chief Actuary.

The Canada Revenue Agency. With jurisdiction over some pension funds, the CRA ordered the Ryerson University Pension Plan to distribute their 18% surplus. In 2000, professors, including me, received as much as $20,000 each.

Canada’s Auditor General. They audit most government organizations for fraud, mishandling of funds, inaccurate reporting and injustice to Canadians.

A CPP Board of Governors. Pension experts claim the success of every pension fund depends on a representative Board of Governors, composed primarily of contributors and pensioners. Actuaries report to them. The Board decides on investment policies, surplus payments, pension payments and contribution amounts. (CPP Investments has a very competent Board of Governors but their mandate involves investment decisions only.)

Regrettably, our Chief Actuary is not subject to scrutiny from any of these organizations. He has full control. An email to me from Finance Minister Chrystia Freeland shows she has little comprehension regarding our CPP. Meanwhile, one top Canadian actuary with a conscience stated, with disgust:

“Our Chief Actuary has done what pension actuaries frequently do - invent measures that are easily manipulated so that actuaries can control the narrative and hide things at will...I must remain anonymous because I am not allowed to criticize my fellow actuaries.”

Based on my eight years of research, after poring through thousands of pages of reports prepared by our Chief Actuary, I heartily concur with this disgraceful assessment.

Despite this undisputable CPP surplus, our Chief Actuary has stated to me, "The CPP is not in surplus" and “No further comment.”. Moreover, in thousands of pages of his reporting, he never mentions “surplus” even though our CPP now has a $400 billion surplus. Our Chief Actuary is supposed to serve Canadians with accuracy and honesty. Instead, he has chosen to deceive us so that he can protect his fellow actuaries in his at-risk industry.

Years ago, most Canadians paid with cash. When we gave a cashier a $20 bill for something costing $16.50, most of us scrutinized the change returned for accuracy. Meanwhile, as we all contribute 12% of our income to the CPP, we wrongly presume it is being handled with appropriate care, never suspecting three industries would greedily collude to conceal a $400 billion surplus that belongs to us.

Malcolm Hamilton, an actuary, is one of Canada’s foremost experts on pensions. He is associated with the C.D. Howe Institute, a think tank that will not reveal who funds them. Even though Malcolm could probably command $1,000 per hour as a consultant, he curiously spent 40 hours trying to convince me the CPP has no surplus. He failed miserably, using ridiculous arguments.

The disgraceful C.D. Howe Institute, probably funded by the financial industry, irresponsibly published a misinformation paper that suggests our CPP pensions are in jeopardy!

Did the Canadian Institute of Actuaries recently hold this meeting?

“Good day, fellow actuaries, from your President,

We cannot let Canadians know that CPP Investments’ will likely continue investing so successfully. Combined with the current $400 billion surplus, continued investment success means future CPP pensions will be so large that most Canadians will stop contributing to any other pension plan. A $100,000 CPP pension in 2025 dollars is probable for a 25-year-old. If Canadians know this, there will be a huge decline in the demand for other pension funds, and hence actuaries. We must act now to protect our at-risk industry.

Unfortunately, Professor Macnaughton’s CPP surplus analysis has obviously reached Premier Smith of Alberta. Her Alberta Pension Plan website boasts a surplus payment to seniors of as much as $10,000 each if Alberta receives their share of the $675 billion CPP fund. It also suggests Albertans and their employer will enjoy a $1,425 contribution reduction per employee per year.

Soon, citizens and businesses from other provinces will be saying,

‘If Albertans are scheduled to receive $10,000 each and a $1,425 contribution reduction per year, what about my province and me?’

Then complicit premiers will be forced to listen. The entire CPP surplus story will then be impossible to suppress, especially with the threat of social media looming.

Upon learning of the CPP’s surplus, Premier Smith probably asked the federal Liberals for a Canada-wide CPP surplus distribution. Thanks to the bribes by our friends in the financial industry, the Liberals refused. Then Premier Smith demanded Alberta’s share of the surplus, which is her right. She hired our actuarial friends at Lifeworks to determine how much Alberta deserves.

Here is a crucial question that must be now answered: How can we continue to keep this inconvenient news of the CPP’s surplus suppressed? We need to think outside the box.”

After many hours of thinking outside the box, members of the Institute presented a risky but effective strategy as follows:

“Even before her CPP request, our media has portrayed Premier Smith as an unhinged, un-Canadian, uncooperative premier who couldn't care less about the rest of Canada as long as Albertans benefit. We can use this portrayal to our advantage. There is an obscure clause in The Canada Pension Plan Act that, if taken verbatim, lets Lifeworks theoretically suggest Alberta deserves an outlandish 53% of the CPP’s $675 billion fund. It will slightly tarnish Canadians’ opinion of Lifeworks and actuaries but we must risk it. Actuarial science is so complex that few people will question it, especially since we are only following The Canada Pension Plan Act.

If we can get our friends controlling the media to attribute this ridiculous 53% claim to Premier Smith and not Lifeworks, Albertans and all Canadians will presume she is unhinged and all statements she makes regarding the CPP and its surplus should be ignored.

Canada’s media owners, thanks to cash from the financial industry, have never mentioned the CPP’s surplus, even though it may be the most newsworthy story in Canada in years. They can now skillfully cooperate and mislead the public into thinking Premier Smith, not Lifeworks’ actuaries, greedily claims 53% of the CPP fund.”

And the media did cooperate, as shown below.

The actuarial deception is ongoing. In the Fall of 2024, our Chief Actuary was asked to report her version of Alberta’s share of the fund. She refused. To further delay Alberta receiving its share of the fund, she may eventually shortchange Alberta, resulting in Premier Smith forced to consult Canada’s Supreme Court. This could take many years.

Alberta should only leave the CPP if they can still invest their share of the fund with CPP Investments, the best pension fund investor in the world. For example, the OMERS pension fund invests for 1,000 employers. For CPP Investments, subdividing the fund to represent ten provinces would be simple. Then each province could use their surplus share to help their own province. For a province to start their own investment organization would be pension suicide, as history has shown.

A much better solution would involve our likely next Prime Minister, Mr. Poilievre, legislating a Canada-wide CPP surplus distribution.

Democracy - traded in for cash?

There are only 45,000 financial analysts and actuaries in Canada, constituting just over 0.1% of our population. It is likely that the remaining 99.9% of Canadians, if informed, would overwhelmingly support a no-risk CPP surplus distribution of $200 billion. However, all three political parties refuse to propose or even discuss such a distribution. The democratic principles in Canada seem to have been abandoned. Instead of:

“Government of the people, by the people, for the people,"

Canadians are receiving:

"Government of the people, by the financial industry, for the financial industry."

Our suspect media, experiencing a shortage of topics, is currently dwelling on foreign interference on our democracy. Our media should focus more on domestic interference, right here in Canada. It is probably having 1,000 times the impact on the day-to-day lives of struggling Canadians.

The following is a stretch but it should be mentioned. Did the NDP, in a state of desperation, threaten to offer a CPP surplus distribution to all Canadians? Is it plausible that our Liberal government, possibly influenced by prodding from the financial industry, proposed a strategy of appeasement by forming the 2024 Liberal/NDP coalition? This coalition has provided dental care for children in low-income families and some Pharmacare. Canadians would probably prefer a $200 billion CPP surplus distribution over limited dental care and Pharmacare. However, we don’t get a choice.

Every year, thousands more Canadians’ lives are being shortened

There are two million Canadian seniors now living near the poverty line of $22,000 in income per year. Two thirds are women. An additional $10,000, similar to a 40% raise, could vastly improve their quality of life and longevity. Please recall that it was their money, and yours, that was used by CPP Investments to create this gigantic surplus.

Consider the plight of those 100,000 suffering low-income Canadian seniors expected to pass on in the next 12 months. Struggling to survive on an income near the poverty line, they can barely pay for rent and day-to-day living expenses. An additional $10,000 from the CPP’s surplus would lead to a substantially improved quality of life and a longer life. They could, for example, travel, dine out, buy a car, visit grandchildren, visit Florida, play golf, and enjoy all the other activities wealthier retirees take for granted.

One study shows that those seniors in the top quintile of income live 13 years longer than those in the bottom quintile. Tragically, the lives of these suffering seniors are being cut short because of the greed of millionaires in the financial industry. Intentionally shortening the lives of thousands of people is called genocide.

What about the benefits of an extra $1,000 to a low-income senior as opposed to a banker? The Economist recently wrote,

“The marginal benefit of an extra $1,000 is greater for the poor than the rich. A hungry family might buy food for a month; a banker might blow that amount on a single dinner, not including the wine.”

Next year, another 100,000 struggling seniors will die earlier than they should. Since 2016, roughly one million low-income seniors have died earlier than they should, with a lower quality of life. Please help stop this cover-up. Suggestions are below.

There are also 200,000 middle-income and high-income Canadians who will also die this year, never receiving their deserved surplus payment, which is closer to $15,000 each.

Generational equity, or fairness to all, is the primary goal of all pension fund managers. Disgracefully, our Chief Actuary has ignored this multibillion dollar responsibility to protect her at-risk industry and the financial industry.

Bank presidents are the most guilty…and could easily stop this cover-up

Banks oversee 70% of the $10 trillion in total financial assets in Canada. The bank presidents in the five big Canadian banks are each paid roughly $15 million per year to keep their profits flowing. Arguably, they represent 70% of the financial industry. If they agreed, one phone call to our politicians saying,

“The jig is up. Forget the bribes. Let’s release the CPP’s surplus. Our banks’ image (and my legacy reputation) are too much at risk.”

Because they refuse to use their power and influence to cancel this cover-up, they are guilty of depriving millions of struggling Canadians of the benefits listed above. This is a complete contradiction of their declared mandate. For example, TD bank’s slogan is “Enriching the lives of those we serve.”. A more accurate slogan is “Worsening the lives of those we serve.”

These organizations are also guilty

The tentacles of the greedy financial industry are ubiquitous. Canada's two foremost seniors' advocacy groups, CARP and CANAGE, have a mission statement that claims they will advocate vigorously for the well-being of seniors. For example, CARP’s stated mandate is to "Promote and protect the interests, rights, and quality of life for Canadians as we age."

However, both CARP and CANAGE, despite receiving repeated CPP surplus details from me, have not responded. Of a $200 billion CPP surplus distribution, seniors would receive $60 billion. As Canada’s only influential advocate for seniors, this failure to respond is especially suspicious because CARP and I partnered to secure an additional $440 million per year in GIS payments for low-income seniors. This failure to meet their mandate is probably caused by substantial "donations'' received from the financial industry. The agreement may have been worded as, for example,

“We will donate $10 million to your organization on the condition that you never mention the CPP’s surplus.”

Our CRA frowns on nonprofits like CARP that receive income from the public but do not match their advertised mandate. The CRA has been notified.

Eight years ago, I viewed think tanks with great respect. I thought they were packed with ethical experts who advise naive politicians regarding the best legislation for Canadians and Canada. However, think tanks are also curiously mute on the CPP’s surplus. Three facts confirm that they are a well-disguised scam:

Several think tanks have received the above details and never mentioned the CPP’s surplus. Instead, some have even written papers claiming our CPP pensions may be in jeopardy.

Malcolm Hamilton, the high-level actuary who suspiciously spent 40 hours trying to convince me there is no surplus, is associated with the C. D. Howe Institute, a think tank that refuses to reveal who funds them.

Canadians have no idea who funds these think tanks. Those Canadian think tanks that write about financial issues have all received an underwhelming rating between zero and two, out of 5, for revealing who funds them. The evidence is convincing that the financial industry has paid think tanks to promote policy that favours the financial industry, not the other 99% of Canadians. Regrettably, because many politicians do not have the time, background or skill to properly analyze complex issues, they listen to think tanks extensively.

In 2017, Konrad Yakabuski of the Globe and Mail, wrote:

“Between 2000 and 2015, representatives from Canada's 10 leading think tanks appeared at least 216 times before parliamentary committees and were cited in the Canadian media almost 60,000 times. It gave them and their research priceless exposure and influence in shaping government policy.”

For comparison, the CPP’s gigantic $400 billion surplus has been cited in the media zero times. Please compare zero to 60,000 on an issue involving almost 3,000 times as much money as the $60 million ArriveCan scandal.

We Canadians proudly think freedom of speech and freedom of press flourish in Canada, much more successfully than in almost every other country. This is not true. Here is why:

No media in Canada, including “our” CBC, will publish any details about the CPP’s surplus and potential to solve many of our problems, especially those of the less fortunate.

Allegedly reputable leftwing organizations like CARP and CANAGE have abandoned seniors and abandoned their alleged mandate, probably thanks to generous “donations” from the financial industry.

Think tanks, the generously paid, biased mouthpiece of the financial industry, can gain huge access and influence with politicians and the media.

Individual leftwing researchers like me represent 99% of Canadians. After presenting the above details to my three MPs and all 334 MPs via email, I have received almost zero response. Moreover, any active professor seeking funding for this type of research would probably be rejected by the university’s administration. Why? Such research would lead to a decline in donations to the university from the financial industry.

The tentacles of the greedy financial industry are ubiquitous. This explains why Ms. Freeland and Mr. Carney claim our capitalist system is rigged to favour the super-rich. And why Mr. Poilievre claims “Our system is broken.” And why Ms. Freeland thinks:

"The super-rich have bankrolled a network of conservative think tanks, elite journals, and mass media outlets to dominate the debate over economic policy."

The Save it for a Rainy Day Argument

Some critics suggest we should leave the CPP’s surplus alone, in case CPP Investments suddenly has poor returns. This scenario is especially unlikely because of the diversification of CPP Investments. They are invested in public equity, private equity, real estate, infrastructure, fixed income and credit, all over the world. If a few investments fail, hundreds of other safe investments will offset this failure. Conversely, most individual investors and smaller Canadian pension funds are only invested in public equities, predominantly Canadian companies. If the stock market declines, these pension funds will decline in virtual lockstep. This suggests a CPP surplus distribution is much less risky than with other pension funds.

Finally, generational equity demands a surplus distribution when the surplus is 25% above target or older members of the fund will be deprived. The CPP’s surplus is now 238% above target.

If Untrue, these Claims Merit Legal Action.

It is essential to highlight that, if I am spreading misinformation, I could potentially face a significant "defamation of character" lawsuit. I am leveling accusations against various organizations and individuals, alleging that they have forsaken their fellow Canadians and fallen drastically short of fulfilling their purported mandate.

Despite making these claims for years, no legal action has transpired. This absence of a legal challenge underscores the accuracy of the above information. Furthermore, a court would likely align with the perspective of 99% of Canadians. Finally, the fallout from an unsuccessful, publicized lawsuit could spell disaster for these implicated individuals and organizations that have likely abandoned millions of Canadians for cash.

Seventeen questions that can only be answered with one word:

BRIBERY

Bribery is an unsavory word that most Canadians connect with third world countries. Even though bribery is often responsible for depriving millions of low-income citizens of billions of dollars in benefits, our media never uses the word. Many think, as I did ten years ago, that large-scale bribery could never happen in Canada. I was wrong.

Consider Ontario’s Premier Ford. After promising to never release Toronto’s surrounding Green Belt land to developers, he did just that, making the developers roughly $8 billion wealthier. Fortunately, unlike the financial industry, he cannot afford to bribe the entire Canadian media to remain silent. The media revealed his corruption and he has since backpedaled.

On April 25, 2024, the Globe and Mail wrote:

“A former SNC-Lavalin executive has been sentenced to 3½ years in prison in connection with a bribery scheme for a bridge repair contract in Montreal, the RCMP say.

A police investigation revealed that SNC-Lavalin executives paid bribes of roughly $2.3-million in order to secure a $128-million contract to repair the Jacques Cartier Bridge deck in the early 2000s.

In 2017, Michel Fournier, former chief executive officer of Federal Bridge Corp., admitted to receiving the bribes through Swiss bank accounts between 1997 and 2004. He was sentenced to 5½ years in prison.”

The financial industry, with its huge resources and 47% of all corporate profit, is much more subtle and hidden in its efforts to conceal the truth about the CPP. Probably even a RCMP investigation would never reveal the millions of dollars changing hands.

Unless someone can provide answers other than “BRIBERY” to the following questions, I am convinced that our greedy financial industry has used bribery to enrich Canada’s wealthiest 1% at the expense of Canada’s less fortunate 99%.

Here are the questions.

Why do Ms. Freeland and Mr. Carney claim our capitalist system is rigged to favour the super-rich? Why did Mr. Poilievre state “Our system is broken. Fire the gatekeepers.”, probably alluding to our Chief Actuary and the President of the CBC?

Why does David Meslin, Canada’s expert on democracy, claim “Our political system has evolved into a sophisticated enabler of mass institutionalized bribery... powerful corporations continue to wield enormous power in our legislatures.”

Why does democracywatch.ca claim "Corporations spend $25 billion annually on their lobbying and promotion efforts."

Any party could win a majority by proposing a $200 billion CPP surplus distribution, with no risk to future pensions, and a $50 billion reduction in our troubling deficit. The benefits for Canadians and Canada would be immense. Why has no politician from any party ever even mentioned the CPP’s surplus? Almost all have become mute when confronted with the CPP’s surplus, their probable ticket to re-election.

Why did two of my MPs, after a half hour presentation, show enthusiasm for a CPP surplus distribution, mentioning their re-election would be a surety if their party proposed it. They “sent the ideas to Ottawa”. Why did they then refuse to respond to me, despite repeated requests.

Why did my third MP, the principled Jane Philpott, after a half hour presentation, respond with “It is those disgraceful lobbyists.”?

The most newsworthy story in years is about the CPP’s surplus and what a surplus distribution could do for Canadians and Canada. Why has our entire Canadian media never published one word regarding the CPP’s $400 billion surplus, which is more than ten times our average annual deficit and almost 3,000 times the size of the ArriveCan scandal.

Why has “our” CBC never mentioned the CPP’s surplus, despite repeated submissions by me?

Why has no think tank member, actuary, journalist or politician provided one reason to NOT distribute the CPP’s surplus?

Pension fund experts recommend every pension fund should have a representative Board of Governors, primarily composed of contributors and pensioners. Such a Board would have declared a surplus distribution years ago. Why does the CPP not have such a Board of Governors?

Almost all government departments are audited by our Auditor General or our CRA. They are our watch dogs who report on scandals like the ArriveCan scandal. The CPP holds 10% of the lifetime earnings of most Canadians, trillions of dollars. Why is our Auditor General or our CRA not allowed to audit the work of our Chief Actuary?

Why have ten top Canadian actuaries all denied the CPP’s obvious surplus with vacuous arguments?

Malcolm Hamilton is a top Canadian actuary who is associated with the think tank C. D. Howe Institute. They will not reveal who funds them. Why did Malcolm spend 40 hours trying to convince me the CPP has no surplus?

Why did one top actuary near retirement, in a moment of conscience, state our Chief Actuary “invents measures that are easily manipulated so that actuaries can control the narrative and hide things at will.”

Why did CARP and CANAGE, Canada’s two best advocates for seniors’ rights, ignore repeated requests to assist in advocating for a CPP surplus distribution, thereby helping deprive six million seniors of a deserved $10,000 each, $60 billion in total.

Generational equity is the goal of all pension fund managers. To achieve generational equity, most pension funds distribute a surplus when it is 25% above target. The CPP’s surplus is now 238% above target. A $10,000 surplus payment to those 100,000 low-income seniors who will die this year could lead to their increased quality of life and their increased longevity. Why are our politicians and the others complicit in this cover-up not guilty of shortening the lives of thousands of innocent, struggling Canadians?

Why did Lifeworks’ actuaries claim Alberta deserves 53% of our CPP fund when the truth is roughly 16%? Why did the Canadian media then unfairly attribute this ridiculous claim to Premier Smith, portraying her as unhinged and unCanadian. She should have been portrayed as the only politician in Canada impervious to bribes and genuinely concerned for the welfare of Albertans.

A summary of this cover-up, now involving $200 billion

Impact, Understanding and Awareness are Gaining Traction.

Given my widespread dissemination of thousands of emails to influential Canadians, including Alberta Premier Danielle Smith, the news of the CPP’s surplus and potential is gaining traction. Recent developments have heightened the mounting evidence surrounding this cover-up:

CPP Investments’ proud claim: Regrettably CPP Investments’ sole mandate is to invest. They are frustrated because benefits from their outstanding investment success are not reaching Canadians. Possibly because of prodding by me, they have published the graph above that shows them as the best pension fund investor in the world. As millions of Canadians realize their hard-earned contributions have been invested so successfully, they will start wondering “Why am I not reaping the benefits of this investment prowess? After all, it was my money they used to create this ‘gigantic’ surplus.”

Financial Industry wealth and ongoing greed: The news that the financial industry, predominantly composed of greedy, male millionaires, claims 47% of all corporate profits in Canada while contributing only 7.4% to our GDP, is slowly reaching many Canadians. To emphasize how disproportionate 47% is, in the US, including unsavory Wall Street, the financial industry earns 17% of all corporate profits.

Females are being abused more than males. Most wealthy members of the financial industry are males. Conversely, two thirds of low-income seniors are females. Moreover, thousands of struggling single mothers are dealing with no support from absent fathers. Women’s groups have been notified. Regrettably, there is little evidence of their taking action.

Politicians may capitulate: With…

an election on the horizon,

all 334 MPs having received these details,

99% of Canadians likely voting for a surplus distribution,

a surplus distribution giving Canadians and Canada immense benefits,

all three parties complicit in remaining silent,

our deficit and debt mushrooming,

our economy sputtering,

seniors dying much earlier than they should,

an ANYONE BUT THE INCUMBENT (See below) policy looming,

and much more,…complicit politicians may soon agree to ignore the bribes and do the right thing.

Will our next Prime Minister act appropriately? Pierre Poilievre, our probable next Prime Minister, is aware of the CPP’s surplus and potential, as evident in his email response.

On May 3, 2024, Mr. Poilievre, stated in an article published in The National Post, entitled,

“Memo to Corporate Canada - fire your lobbyist. Ignore politicians. Go to the people.”

“Obviously, my future government will do exactly the opposite of Trudeau on almost every issue. But that does not mean that businesses will get their way. In fact, they will get nothing from me unless they convince the people first. So here is a how-to guide for dealing with a Poilievre government.

If you do have a policy proposal, don’t tell me about it. Convince Canadians that it’s good for them. Communicate your policy’s benefits directly to workers, consumers and retirees…Your communications must reach truckers, waitresses, nurses, carpenters, - all the people who are to productive to tune into the above-mentioned platforms.”

It appears the days of the lobbyist, in some cases, briber, will be over when Mr. Poilievre is elected. Time will tell. Meanwhile, encouraged by his guidance, I will send these details to common Canadians - the associations that represent workers, consumers, retirees, truckers, waitresses, nurses, carpenters and many more.

M. Poilievre has openly acknowledged that "Our system is broken.", indicating that scandals like this CPP cover-up are commonplace, and he intends to fix things. Additionally, he wants to “Fire the gatekeepers”, probably including our Chief Actuary who has ignored an irrefutable $400 billion CPP surplus.

Finally, he wants to "Defund the CBC." This is justifiable because “our” complicit CBC president, Catherine Tait, has obviously ordered journalists to never mention the CPP’s surplus, probably obeying instructions from Prime Minister Trudeau.

The question remains: If elected as Prime Minister, will Mr. Poilievre ignore all other pressures and give Canada what 99% of Canadians want – CPP reform? Any pressure exerted by Canadian voters now could play a pivotal role in his moving toward CPP reform.